They never fail to draw me in. #aspen

from Instagram http://instagram.com/p/ihg713BzcS/

They never fail to draw me in. #aspen

from Instagram http://instagram.com/p/ihg713BzcS/

Sunday Funday: "ripping" the trees at Buttermilk #aspen

Sunday Funday: "ripping" the trees at Buttermilk #aspen

from Instagram http://instagram.com/p/ihf8EFhzaT/

Sunday Funday: "ripping" the trees at Buttermilk #aspen

from Instagram http://instagram.com/p/ihf8EFhzaT/

Teepee rising with #Basalt mountain #CO

Teepee rising with #Basalt mountain #CO

from Instagram http://instagram.com/p/h3i_fzBzcl/

Teepee rising with #Basalt mountain #CO

from Instagram http://instagram.com/p/h3i_fzBzcl/

Yum, yum, Chili at Elk Camp Snowmass

Yum, yum. Even though not as cold today. Bread bowl #chili #snowmass

from Instagram http://instagram.com/p/h1VB1zBzcr/

Yum, yum. Even though not as cold today. Bread bowl #chili #snowmass

from Instagram http://instagram.com/p/h1VB1zBzcr/

Even ski areas can be good at #typography #snowmass #co

Even ski areas can be good at #typography #snowmass #co

from Instagram http://instagram.com/p/hrfo3lBzQ7/

#carbondale legend: The Village Smithy

#carbondale legend: The Village Smithy

from Instagram http://instagram.com/p/hrezhfBzff/

hitting the ground running #gourmet #donut #coffee #carbondale

#jolt hitting the ground running #gourmet #donut #coffee #carbondale

from Instagram http://instagram.com/p/hi_51ZhzU9/

Things I am enjoying

Having two dogs, both pretty much puppies, has been challenging but also a lot of fun. Besides all the love and laughter they bring, they also provide me the opportunity to walk more. The multiple exercise sessions a day along with two young kids has forced me (in a good way) to get more efficient with my work and life. As a result, I have been listening to a lot of podcasts and playing with some cool software.

I am loving the following and thought they are worth sharing:

Having two dogs, both pretty much puppies, has been challenging but also a lot of fun. Besides all the love and laughter they bring, they also provide me the opportunity to walk more. The multiple exercise sessions a day along with two young kids has forced me (in a good way) to get more efficient with my work and life. As a result, I have been listening to a lot of podcasts and playing with some cool software.

I am loving the following and thought they are worth sharing:

Hittal: Killer Keyword Suggestions (link)

HitTail tells you, in real-time, the most promising search terms you should target based on your existing traffic. We do this using a sophisticated algorithm tuned by analyzing over 1.2 billion keywords.

HitTail analyzes your visitor stream in real-time and provides you with a simple, actionable list of precisely which keywords you should be targeting to dramatically grow your organic search traffic.

Trello (link)

Whether you're planning a surprise birthday party for your best friend, writing an epic screenplay, tracking million-dollar sales leads, or just making a list of stuff to get done this weekend, Trello makes sure you're organized and on top of it all. Like a whiteboard with super powers, Trello is simple to use and infinitely flexible. You'll know exactly what needs to get done, who's going to do it, and what's coming up next. And, everything you do is synced and saved instantly to Trello.com. Use the web site to stay organized while you're at your desk, and the app to stay up to date while you're out and about.

Contactually (link)

an assistant that helps you automatically prioritize and stay in touch with your most important contacts, including potential business leads, colleagues, and friends. Regularly reconnecting with your network can improve your relationships and create opportunities in the future. It pulls in all of your email, social, and CRM contacts, so it always knows who you're talking to.

Bootstrapped With Kids Podcast (link)

Two dudes with kids talking about software, marketing, making money and other Sh!t.

Bigger Pockets Podcast (link)

Real Estate Investing & Wealth Building without the hype.

Start-ups for the Rest of Us (link)

Mike Taber and Rob Walling come together to share their insights and experience from the perspective of developers who built their respective companies without Angel or Venture Capital funding. Together, they share the things they've learned and are still learning as independent developers.

What are you enjoying?

The Pros and Cons of Triple Net Properties

In some ways, triple net properties are as much fixed-income investments as they are real estate vehicles. Offering little to no management responsibility and long-term fixed incomes with the potential for gradual increases, they act like bonds. However, underlying their financial structures, they are still real estate and carry the same eventual risks and challenges.

Here are some of the pros and cons of triple net lease properties.:

In some ways, triple net properties are as much fixed-income investments as they are real estate vehicles. Offering little to no management responsibility and long-term fixed incomes with the potential for gradual increases, they act like bonds. However, underlying their financial structures, they are still real estate and carry the same eventual risks and challenges.

Here are some of the pros and cons of triple net lease properties.:

Pro: Stable Income Con: Limited Upside Triple net leases are usually structured with a flat rent or with fixed increases. When you buy a $2,000,000 property at a 7.5 percent cap, you know that you can count on $150,000 per year for the life of the lease. Many triple-net properties also have rent increases of 1 to 3 percent per year built-in. They provide some growth, but don't necessarily keep up with inflation. However, this is no different from buying a corporate, Treasury or municipal bond with a fixed rate of return.

Pro: Long-Term 100% Occupancy Con: Risk of 100% Vacancy Most triple net properties come on the market with a lease of at least 10 years, with some having initial terms as long as 25 years. This gives you a long time during which you don't have to worry about partial or full vacancy. The drawback is that when the lease does expire, it's an all-or-nothing proposition. The same occurs in the event of a tenant default, although careful due diligence before purchase can reduce the risk of this occurring.

Pro: Attractive Cap Rates

Con: High Price Relative to Underlying Value

Single tenant properties typically trade at attractive cap rates that are hundreds of basis points above comparable non-real estate investments. They're also frequently priced lower than more traditional investment real estate alternatives on a cap rate basis. A large portion of their value comes from their income stream, though, meaning that they could lose value when vacant or as their remaining lease term decreases.

Pro: Attractive Cap Rates

Con: High Price Relative to Underlying Value

Single tenant properties typically trade at attractive cap rates that are hundreds of basis points above comparable non-real estate investments. They're also frequently priced lower than more traditional investment real estate alternatives on a cap rate basis. A large portion of their value comes from their income stream, though, meaning that they could lose value when vacant or as their remaining lease term decreases.

Pro: No Management Con: CapEx at Rollover True triple net properties are structured so that the owner has no responsibilities whatsoever during the lease period, while others transfer some capital expenditures to the owner. In either case, the ownership experience is very different from traditional real estate. However, when the lease rolls over, owners have to get involved in the re-leasing process and in any necessary capital expenditures to prepare for a new tenant.

What do you see as the benefits and risk?

Contact Thomas Morgan, CCIM Triple Net NNN Broker at 1-866-539-1777

Humor? Real Estate Photos

↑ Is that someone sleeping in this photo?

↑ Looks like they're trying to kill two birds with one stone, you can house shop and garage sale shop in one photo!

Broker BS or Good Salesmanship?

I had inquired about a portfolio of net leased reatuarants. The NNN deal is listed by "one of the big" firms and I received back an email with this below the property information:

I had inquired about a portfolio of net leased reatuarants. The NNN deal is listed by "one of the big" firms and I received back an email with this below the property information:

As I stated earlier, if your clients like the deal it will be getting done at list price. Take a look at the comps, because they do a solid job of justifying our cap rate. Let me know, if you have any questions. They would need to have an offer in by this coming Monday at the latest.

In my eyes, at least 75% of it is BS. Yes, it could be called good salesmanship and trying to get the highest price for the seller; which is fine, he is doing is job then. However, in my experience, this is classic false urgency. It's like when I submitted an LOI on a Walgreens in Pine Bluff Arkansas in Dec 2012 and they say they have 6 offers above list price and it will close before end of 2012 all cash. Sure. It has been back to market at least three times since then and may even still be for sale today.

In my eyes, at least 75% of it is BS. Yes, it could be called good salesmanship and trying to get the highest price for the seller; which is fine, he is doing is job then. However, in my experience, this is classic false urgency. It's like when I submitted an LOI on a Walgreens in Pine Bluff Arkansas in Dec 2012 and they say they have 6 offers above list price and it will close before end of 2012 all cash. Sure. It has been back to market at least three times since then and may even still be for sale today.

Yes, the net lease market is hot. But my clients are smart, know what they want and if they like it they will act fast and make an offer based on their underwriting. If we wanted your input we would ask.

More power to the broker if they have several offers at list price by Monday however I suspect I will see that deal at least 2 or more times in email blasts etc.

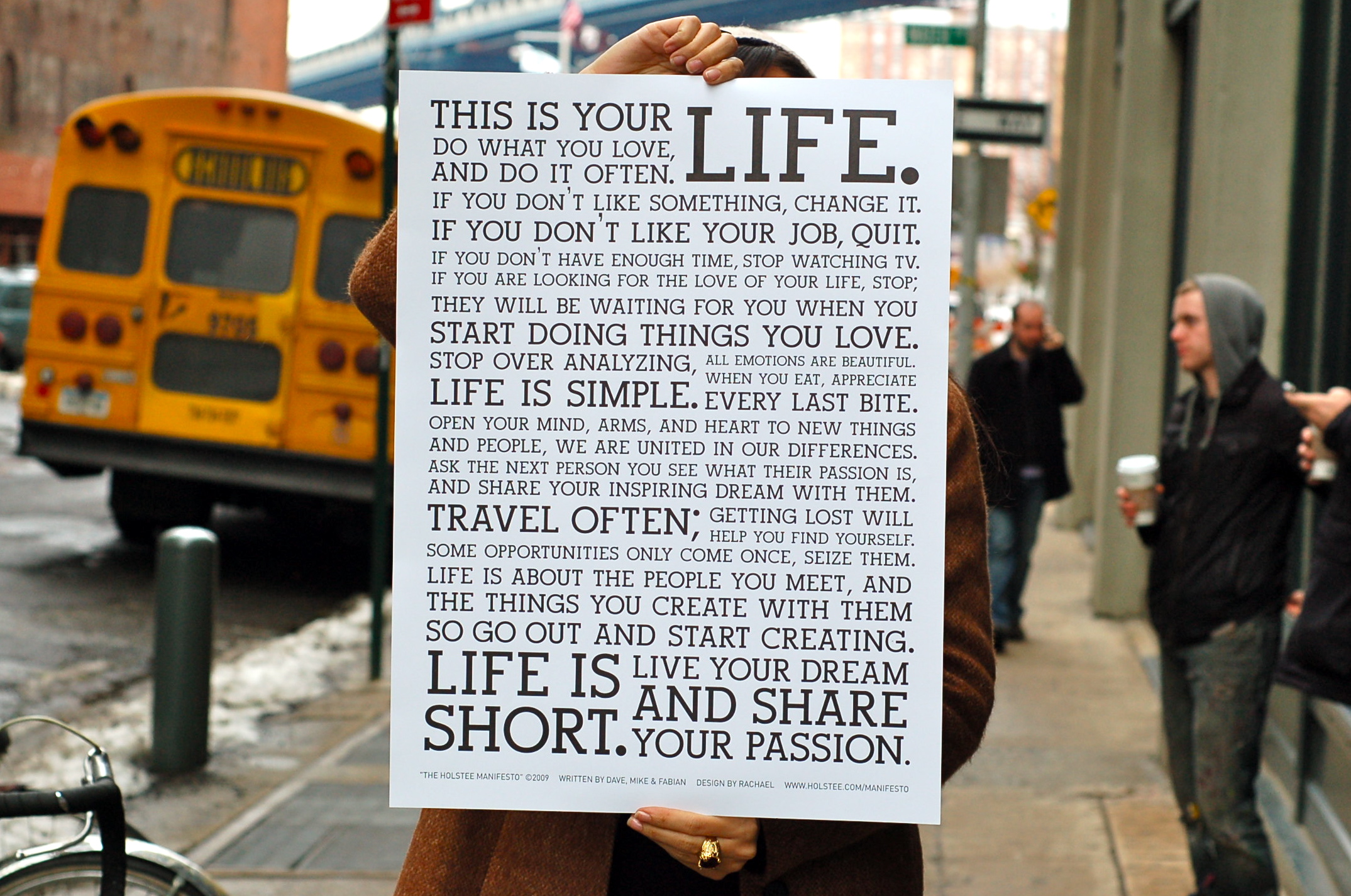

This is Your Life; Do what You Love

"This is your life.

Do what you love and do it often."

via "The Holstee Manifesto"

via About | HOLSTEE.

Current NNN Cap Rates

Agreed: "Net Lease Market Remains White Hot"

Cap rates for the single tenant net leased market remained near historic lows for retail, office and industrial sectors in the first quarter of 2013. Cap rates for net lease office and industrial properties declined while retail cap rates remained at 2012 fourth quarter levels.

via Net Lease Market Remains White Hot | Commentary content from National Real Estate Investor.

HELP! Millionaire client needs money to pay hotel bill

Below is an e-mail received by me and several others from a client of mine. Note that my client is a very high net worth real estate investor.

I thought it was worth reposting as I laugh everytime I read it. Obviously, his yahoo account had been hacked.

Below is an e-mail received by me and several others from a client of mine. Note that my client is a very high net worth real estate investor.

I thought it was worth reposting as I laugh everytime I read it. Obviously, his yahoo account had been hacked.

How are you doing? This has had to come in a hurry and it has left me in a devastating state. I,Terry, and Joey had a trip down to Spain unannounced some days back for an important program, unfortunately we got mugged at the park of the hotel where we stayed,all cash, cell phones and credit cards were stolen from us but luckily we still have our passports with us.

We been to the Embassy and the Police here but they're not helping issues at all and our flight leaves tomorrow but we am having problems settling the hotel bills and the hotel manager won't let us leave until we settle the bills. Please we really need your financial assistance..Please, Let me know if you can help us out?

I'm looking forward to hearing from you.

I guess people fall for these and the Nigerian Money Scams, otherwise they would not go through the time and effort.

An, no, my client nor the recipients fell for it.

Historic Bank Property to become Brewpub

Always looking for examples of historic reuse as well as certain property type reuse (like banks, movie theaters, bowling alleys, etc). Saw this on facebook tonight. Seems like a steal @ $26 psf despite the redevelopment cost.

via Frank Thomas Big Hurt brewpub on deck in Berwyn - News - Crains Chicago Business:

The Berwyn City Council last week approved a redevelopment ordinance to convert the 6,500-square-foot local landmark to the flagship brew house. The 88-year-old limestone building will be sold for $200,000

Looks like the City was eager to put a deal together. This comes via the loopnet listing:

For the right end user, the City will use the following incentives:

- Land write-down to $500,000 for 50,000 square feet of land + historic bank building - A 100% write down of $500,000 in previous investment - Expedited Permitting - Class L Property Tax Exemption - Historic Income Tax Credits

This iconic structure is currently owned by the City of Berwyn. The City is looking to bring a unique concept to the location that residents will be proud of. The City is willing to be very aggressive with the sale price and will consider lease terms as well.

The building was structurally restored in 2010 and is extremely spacious. Nearly 6,000 SF of open space on the ground floor and an additional 1,600 SF split between two mezzanine areas.

Rather than speculative developers or investors, the offering price is designed to bring a unique end user into the City.

Located in the heart of Berwyn's bustling Cermak Road, the Berwyn National Bank building sits at the crossroads of Cermak Road (33,900 ADT) and Oak Park Ave (11,400 ADT).

Zoned C-2 (General Commercial) with Retail Overlay.

Shared parking with access to the municipal parking lot across the street.

Please send us any more examples of Bank Reuse or other historic property reuse. I am happy to post any of your projects.

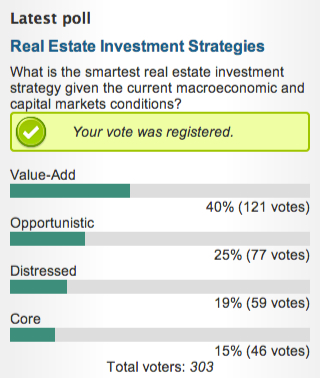

What is the smartest real estate investment strategy?

Great question posed on National Real Estate Investor online as a poll. My answer: Value-Add

Looks like I scored an "A" on this test.

What strategy are you pursuing?

Here is a quick summary of real estate investment strategies via Wikipedia:

Private equity real estate funds generally follow core-plus, value added, or opportunistic strategies when making investments.

Core Plus: This is a moderate risk/moderate return strategy. The fund will generally invest in core properties however some of these properties will require some form of enhancement or value-added element.

Value Added: This is a medium-to-high risk/medium-to-high return strategy. It will involve buying a property, improving it in some way, and selling it at an opportune time for a gain. Properties are considered value added when they exhibit management or operational problems, require physical improvement, and/or suffer from capital constraints.

Opportunistic: This is a high risk/high return strategy. The properties will require a high degree of enhancement. This strategy may also involve investments in development, raw land, and niche property sectors. Investments are tactical.

What? That's the lease price?

$2,630 psf That's the sale price per foot right?

Nope.

That's the lease price.

And I thought Walgreens paid a lot per foot for their NNN leases.

Based on below, how much would the building be worth if I rented a 1,000 sf building in Hong Kong Causeway Bay to Prada for the going rate of $2,630 psf? Let's assume NNN rent and going cap rate for such a primo location is 4% (which might be high!)

Based on below, how much would the building be worth if I rented a 1,000 sf building in Hong Kong Causeway Bay to Prada for the going rate of $2,630 psf? Let's assume NNN rent and going cap rate for such a primo location is 4% (which might be high!)

Annual rent: $2,630,000

Value at 4 cap: $65,750,000 for my 1,000 sf space

So... $65,750 psf to buy the space.

Makes Walgreens $300 to $400 psf look like a steal! Or Aspen at $1,000 psf is also a steal.

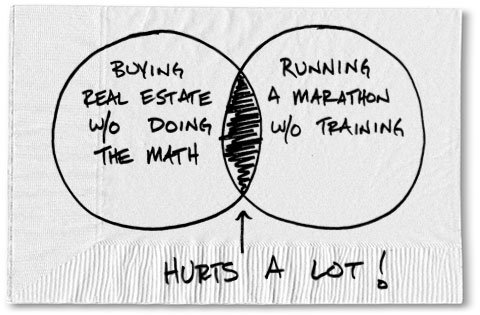

The Dangerous Allure of Distressed Real Estate

But that's why the yield is higher! Love the napkin sketch........

Buy Opportunistic Real Estate and Value Added Real Estate (links)

via The Dangerous Allure of Distressed Real Estate - NYTimes.com.

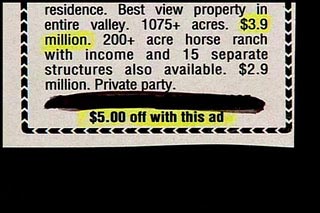

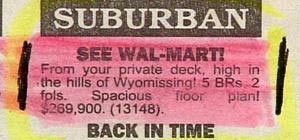

Humor: Typo-challenged Real Estate Ads

Who needs a beach or mountain view when you can look at Wal-mart from your back deck?

via For Sale by Typo-Challenged Owner: Funny Real Estate Ads - The Laughing Stork.