When purchasing a single tenant net leased investment, tenant quality and the financial ability of the tenant to perform is of utmost importance.

In essence you are buying the income stream and the bundle of rights subject to the leasehold. What helps you evaluate the tenant as an investment grade tenant? How do you know you will get you monthly rent check for 10, 12, 15 or 20 years? One way is to have the "market" rate the risk for you.

When purchasing a single tenant net leased investment, tenant quality and the financial ability of the tenant to perform is of utmost importance.

In essence you are buying the income stream and the bundle of rights subject to the leasehold. What helps you evaluate the tenant as an investment grade tenant? How do you know you will get you monthly rent check for 10, 12, 15 or 20 years? One way is to have the "market" rate the risk for you.

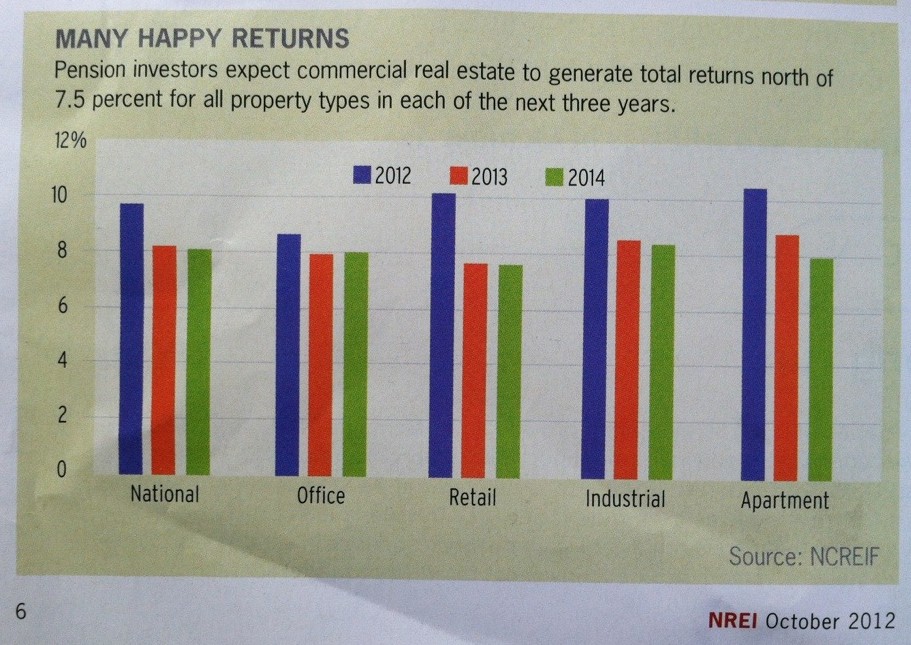

Here is the S & P breakdown of credit ratings, to help you assess your risk. Investment grade tenants are rated BBB- or better.

Long-Term Issue Credit Ratings

from S&P

Issue credit ratings are based, in varying degrees, on the following considerations:

Likelihood of payment—capacity and willingness of the obligor to meet its financial commitment on an obligation in accordance with the terms of the obligation; Nature of and provisions of the obligation; Protection afforded by, and relative position of, the obligation in the event of bankruptcy, reorganization, or other arrangement under the laws of bankruptcy and other laws affecting creditors' rights.

Issue ratings are an assessment of default risk, but may incorporate an assessment of relative seniority or ultimate recovery in the event of default. Junior obligations are typically rated lower than senior obligations, to reflect the lower priority in bankruptcy, as noted above. (Such differentiation may apply when an entity has both senior and subordinated obligations, secured and unsecured obligations, or operating company and holding company obligations.)

AAA

An obligation rated 'AAA' has the highest rating assigned by Standard & Poor's. The obligor's capacity to meet its financial commitment on the obligation is extremely strong.

AA

An obligation rated 'AA' differs from the highest-rated obligations only to a small degree. The obligor's capacity to meet its financial commitment on the obligation is very strong.

A

An obligation rated 'A' is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligations in higher-rated categories. However, the obligor's capacity to meet its financial commitment on the obligation is still strong.

BBB

An obligation rated 'BBB' exhibits adequate protection parameters. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitment on the obligation.

BB, B, CCC, CC, and C

Obligations rated 'BB', 'B', 'CCC', 'CC', and 'C' are regarded as having significant speculative characteristics. 'BB' indicates the least degree of speculation and 'C' the highest. While such obligations will likely have some quality and protective characteristics, these may be outweighed by large uncertainties or major exposures to adverse conditions.

BB

An obligation rated 'BB' is less vulnerable to nonpayment than other speculative issues. However, it faces major ongoing uncertainties or exposure to adverse business, financial, or economic conditions which could lead to the obligor's inadequate capacity to meet its financial commitment on the obligation.

B

An obligation rated 'B' is more vulnerable to nonpayment than obligations rated 'BB', but the obligor currently has the capacity to meet its financial commitment on the obligation. Adverse business, financial, or economic conditions will likely impair the obligor's capacity or willingness to meet its financial commitment on the obligation.

CCC

An obligation rated 'CCC' is currently vulnerable to nonpayment, and is dependent upon favorable business, financial, and economic conditions for the obligor to meet its financial commitment on the obligation. In the event of adverse business, financial, or economic conditions, the obligor is not likely to have the capacity to meet its financial commitment on the obligation.

CC

An obligation rated 'CC' is currently highly vulnerable to nonpayment.

C

A subordinated debt or preferred stock obligation rated 'C' is currently highly vulnerable to nonpayment. The 'C' rating may be used to cover a situation where a bankruptcy petition has been filed or similar action taken, but payments on this obligation are being continued. A 'C' also will be assigned to a preferred stock issue in arrears on dividends or sinking fund payments, but that is currently paying.

D

An obligation rated 'D' is in payment default. The 'D' rating category is used when payments on an obligation are not made on the date due even if the applicable grace period has not expired, unless Standard & Poor's believes that such payments will be made during such grace period. The 'D' rating also will be used upon the filing of a bankruptcy petition or the taking of a similar action if payments on an obligation are jeopardized.

Plus (+) or minus (-)

The ratings from 'AA' to 'CCC' may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the major rating categories.

NR

This indicates that no rating has been requested, that there is insufficient information on which to base a rating, or that Standard & Poor's does not rate a particular obligation as a matter of policy.

Buy an Investment Grade Tenant Property

Other advantages NNN properties offer are significant. An investor can lock in a long-term lease with a tenant who sets up shop in NNN properties. They can

Other advantages NNN properties offer are significant. An investor can lock in a long-term lease with a tenant who sets up shop in NNN properties. They can

Walgreens NNN in CA

Price: $7,250,000

Cap Rate: 5.77%

60-Year Double Net Lease, -Rare Infill Location, -Over 650K Residents in a 5-Mile Radius, Hard Corner, Signalized Intersection, Strong Store Sales, Highly Visible Location.

Walgreens NNN in CA

Price: $7,250,000

Cap Rate: 5.77%

60-Year Double Net Lease, -Rare Infill Location, -Over 650K Residents in a 5-Mile Radius, Hard Corner, Signalized Intersection, Strong Store Sales, Highly Visible Location.  Walgreens NNN in CA

Price: $11,060,000

Cap Rate: 5.75%

Walgreens NNN in CA

Price: $11,060,000

Cap Rate: 5.75%

Walgreens NNN in OK

Price: $5,650,000

Cap Rate: 6.15%

Ten (10), Five (5) year renewal options, Twenty-Five (25) year lease term with Seventeen (17) years remaining, 100% leased and guaranteed by Walgreen Co. (S&P: A)

Walgreens NNN in OK

Price: $5,650,000

Cap Rate: 6.15%

Ten (10), Five (5) year renewal options, Twenty-Five (25) year lease term with Seventeen (17) years remaining, 100% leased and guaranteed by Walgreen Co. (S&P: A)  Walgreens NNN in TX

Price: $7,285,000

Cap Rate: 6%

Strong National Credit, Brand new 25 year absolute NNN lease, Signalized, Hard Corner Location.

Walgreens NNN in TX

Price: $7,285,000

Cap Rate: 6%

Strong National Credit, Brand new 25 year absolute NNN lease, Signalized, Hard Corner Location.  Walgreens NNN in KY

Price: $4,179,000

Cap Rate: 6.75%

Strong corporate Guarantee -Walgreens co., ranked #32 fortune 500 list 2012, America’s #1 Drug store.

Walgreens NNN in KY

Price: $4,179,000

Cap Rate: 6.75%

Strong corporate Guarantee -Walgreens co., ranked #32 fortune 500 list 2012, America’s #1 Drug store.  When purchasing a

When purchasing a

You may have been hearing the words "impact investing" or "social investment". If you care only about making money, read no further. If you care about making a positive difference in the world while making money, read on.

You may have been hearing the words "impact investing" or "social investment". If you care only about making money, read no further. If you care about making a positive difference in the world while making money, read on.

Yes, my iPad is yours; I'll even pay shipping.

Yes, my iPad is yours; I'll even pay shipping.