In today's tech age people are using online banking, balance by text or mobile apps to check their balances or make payments.

Does anyone still use an actual calculator? I mostly use my iphone but when doing some serious math use my HP-10bii or spreadsheets.

In today's tech age people are using online banking, balance by text or mobile apps to check their balances or make payments.

Does anyone still use an actual calculator? I mostly use my iphone but when doing some serious math use my HP-10bii or spreadsheets.

A client and friend told me he has a simple system for counting his money. The guy is worth probably $80M and I expected a series of controls and systems to keep checks and balances. However, this is what he told me about knowing if he is running his business efficiently as well as "the secret to building wealth".

I have a simple thing I do each month. I check the bank statements. If the ending balance is higher than it was last month, then perfect. If the ending balance is lower than it was last month I know I have some hell to raise. In terms of building wealth, the best thing I think a person can do is watch their lifestyle and not let it grow with the amount of money they are making. I always kept my lifestyle pretty much the same. Sure, I splurged and have toys and cars and houses. But over the years, even when I had a big year, I kept our lifestyle the same and never got over extended. I also only pay cash and do not borrow. Banks are your friend when you don't need money and run the other way when you do need it.

I think that is some of the best advice I have ever received about money. What about you? Any good money tips to share?

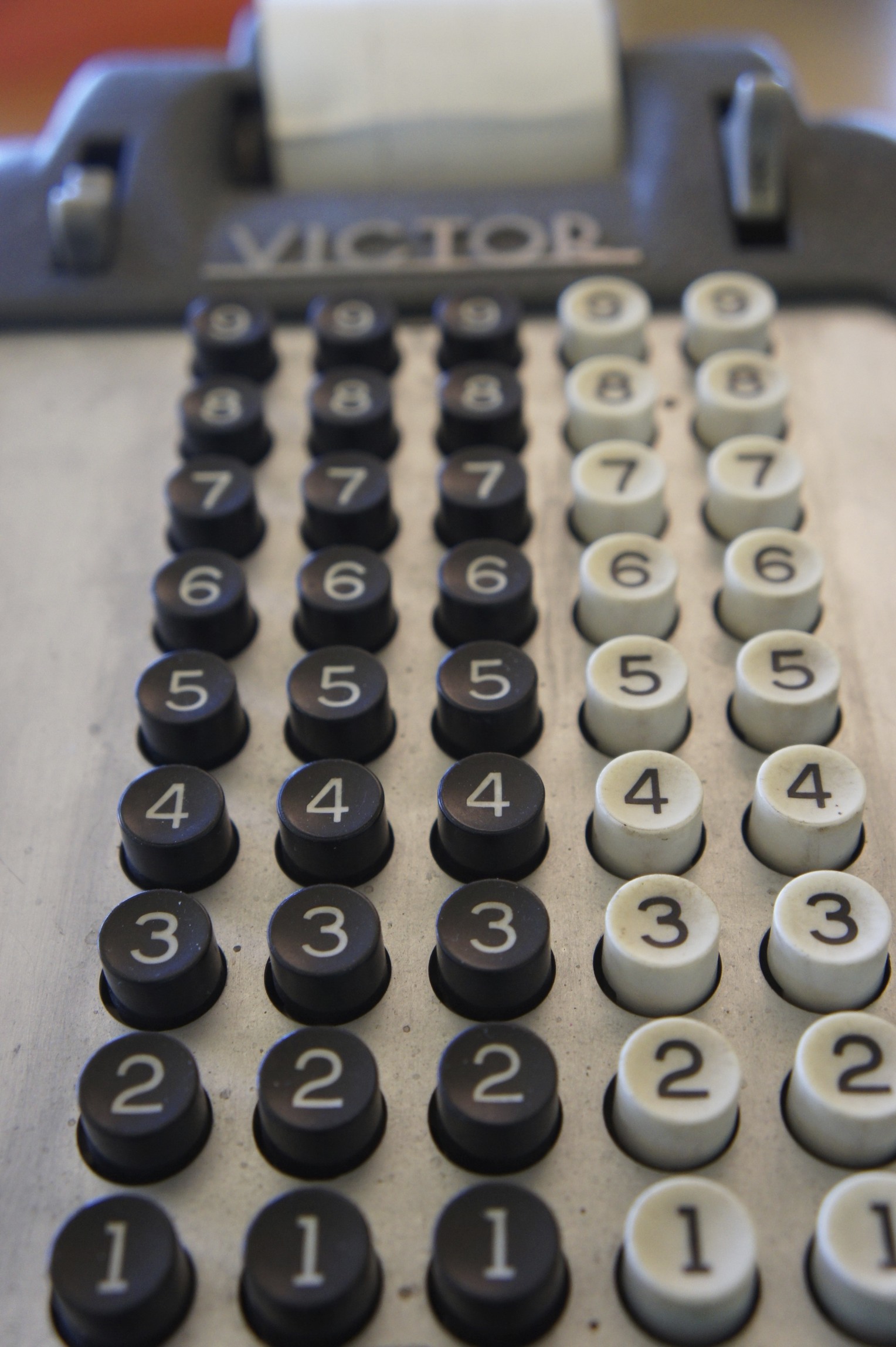

When talking to another client the other day about writing up an LOI on a net leased property, I asked what he wanted to offer. He said "hang on a second" and all a sudden I heard an adding machine in the background. Seriously. You know the electric kind with the paper tape. He was doing a quick cap rate calculation to figure his offer price. After we got the serious details out of the way, I almost asked "Do you save or file the paper tapes?" But I didn't. It is his system and it works for him.

Here are a few photos of an antique Victor adding machine I bought at a rummage sale for $27. And, no, I don't save the tapes each day.

I was interested to see if I got a deal at $27. This is what I found:

Company History Victor Adding Machine Co. was a fledgling company in 1918 when the operator of a successful chain of meat markets gave a Victor salesman $100 for what he thought would buy an adding machine. Instead, he got 10 shares of the company’s stock. In an effort to protect his investment, that man – Carl Buehler – became a director of Victor in September 1918 and was elected president of the company three months later. The first Victor adding machine, Model 110, was introduced in 1919.

Usage his machine was widely used in offices for doing fast additions and calculations. The results were printed. Input from a ten digits keyboard in a 9x10 matrix. Extra function-keys to the right.

Cost The first Victor adding machine, the Model 110 , was introduced in 1919 and proved to be an extremely successful device. The Victor 110 was a full-keyboard non-printing machine with a front-mounted register, with only repeat and zeroing keys. The company sold 100000 of its Model 110 by 1926. The early nonprinting model cost $85, the model without carriage cost $100, the model with carriage $125. In 1921 the machine was extended at the rear to include a printing mechanism and was released as the 200 series. At a retail price of $100, 2000 units sell in the first year.

Current Value

- Antique Victor Adding Machine Brown Bakelite with Green keys circa 1940 It WORKS (Price: $75)

- A 1920s Victor Adding Machine. Fair condition. (Price: $100)

Source: ebay

So yes, it looks like I did OK. If I sold it, which I'm not, I would stand to make a few bucks.

Do you think the Victor can calculate the IRR?