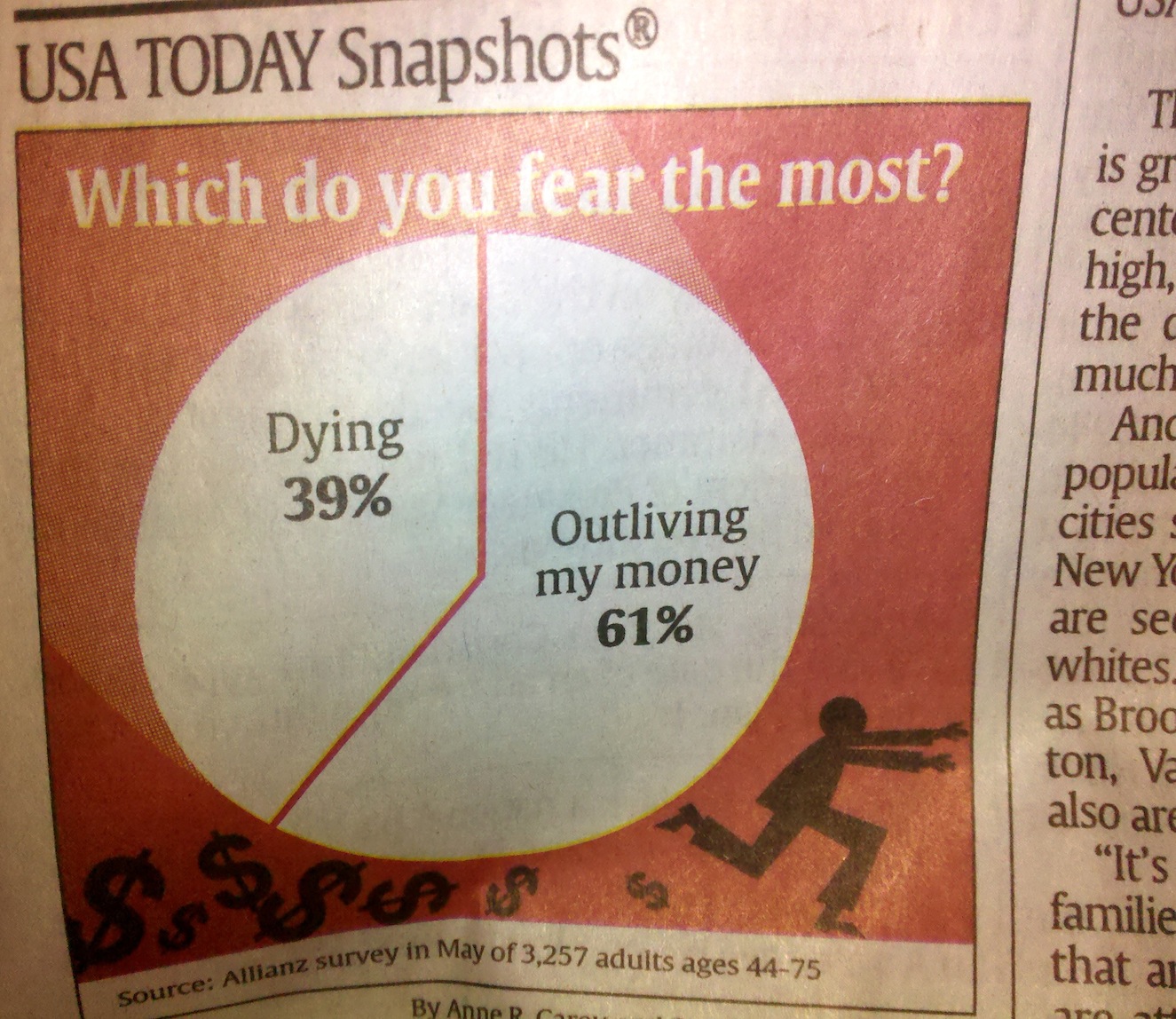

What do you fear most? Death or outliving your money? As one of their daily snapshots this week, USA Today published the results of a survey by Allianz Life Insurance Co asking 44-75 year olds "What do you fear more? Death or outliving my money?

And the results are in….

61% - Outliving my money

39% - Death

Death may be frightening, but to a majority of older Americans, the possibility of outliving their savings is even worse.

Maybe it's me, but that seems crazy: Fear running out of money more than death? To believe that you need what you don’t have is a definition of insanity.

My grandpa used to always say "it's just money, you can always make more" ….but he developed pancreatic cancer as a result of stress from a large business transaction gone south. So, maybe the survey is right. But fear is subjective and we are all entitled to our opinions.

I would rather plan. As the saying goes, if there is a monster chasing you in your dream, stop, turn around and ask it "what do you want?". Facing fears is the best way to eliminate them. In this case retirement fears.

Fear of running out of money is #1 in Sydney Lagier's Three Retirement Fears to Conquer. Regular savings combined with investments into secure low risk investments will help conquer this fear and alleviate worry. It is better to plan and prepare rather than regret and repair.

Objective Retirement Planning: use a retirement calculator. The purpose of every retirement calculator is to tell you one or both of these two pieces of information:

- how much you need to save (usually per month) to be able to retire or

- how big of a nest egg you must have in order to retire

So.... How much income do you need in retirement? Try this retirement income calculator

Also, try these other retirement calculators which include calculators to figure out Retirement Income, Retirement Planning, Fixed Annuities, Immediate Annuities, Long-Term Care and Social Security Benefits.

Here are Four Steps to a Healthy and Prosperous Retirement

- Develop sources of reliable, lifetime retirement income

- Manage your living expenses

- Protect against things going wrong

- Plan for a good life.

At the end of the day, happiness is cheaper in retirement especially when you have planned and have passive income from various investments. The majority of retirees surveyed by Ameriprise Financial say that after a few years of retirement, money worries fade into the background as long as you have planned.