Stroll by the river #old #bridge #aspen

A little family outing a few weeks ago. Visited the final exhibit at the old Aspen Art Museum: Ernesto Neto - Gratitude

Stroll by the river #old #bridge #aspen

from Instagram http://bit.ly/1xYQmRy

CVS NNN For Sale - Available NNN deals

CVS NNN deals continue to be in hot demand. Long term net leases of 20 or more years with a solid credit rated and no landlord responsibilities.

CVS NNN make great 1031 Exchange replacement properties.

CVS NNN deals continue to be in hot demand. Long term net leases of 20 or more years with a solid credit rated and no landlord responsibilities.

CVS NNN make great 1031 Exchange replacement properties.

Here is a quick list of CVS NNN properties for sale that have been of interest to our NNN clients and may be of interest to as well.

CVS NNN Properties For Sale

Call 1-970-618-4086 for more info on these CVS NNN Properties For Sale.

5 Tips for Your Next Ground Lease Investment

Ground lease investment properties are some of the most unique types of NNN opportunities.

While a regular "fee simple" triple net investment consists of both a building and the land on which it sits, a ground lease investment (which is also, technically fee simple) consists of just the ground. Instead of getting rent for the building, you get rent for the use of your ground.

Ground lease investment properties are some of the most unique types of NNN opportunities.

While a regular "fee simple" triple net investment consists of both a building and the land on which it sits, a ground lease investment (which is also, technically fee simple) consists of just the ground. Instead of getting rent for the building, you get rent for the use of your ground.

Here are some tips for how to buy and profit from a ground lease investment:

- Look for good tenants. Frequently, a ground lease investment will have a very strong tenant. McDonalds locations are frequently available as ground leases and many bank branches can also be purchased as ground leases.

- Plan on appreciation. One of the drawbacks to buying a ground lease investment property is that you usually won't be able to depreciate it. The IRS doesn't let you depreciate land since it doesn't lose value over time through deterioration like a building would. The upshot of this is that you're not buying the part of real estate that loses value -- you're getting the good part. While the building on your land might be obsolete in 20 years, the land itself shouldn't be.

- Pay a little bit more. A ground lease investment will usually a carry a lower cap rate than other triple net properties. First, you're usually buying a property with a good tenant, which in and of itself carries a lower cap rate. Second, income from land is usually valued at a higher multiple than income that comes from a mixture of land and building.

- Leverage capital that's been 1031 exchanged a few times. When you've done a few 1031 exchanges, you end up with so much old basis that it gets part to effectively depreciate a new investment. Since you generally can't depreciate a ground lease investment anyways, using your oldest capital to buy it helps to free up money with more basis attached to it for acquiring depreciable assets.

- If it looks too good to be true, it is. Sometimes, you'll see a ground lease asset that seems like a screaming deal -- instead of being a 6.5 cap in an 8 cap marketing, it'll be a 10 cap. If you find one of these, proceed with caution. Sometimes, a broker will list a leasehold interest as a ground lease. When you buy a leasehold interest, you aren't buying dirt, though. You're buying the building and its right to use the land -- which eventually expires. While a leasehold interest can be a good choice, it's very different from a true ground lease investment and is less expensive for a reason.

Contact Thomas for more information about ground lease investments via email or toll free at 1-866-539-1777 or see ground leases for sale.

Silent disco #hippies live

Silent disco #hippies live

Silent disco #hippies live

from Instagram http://bit.ly/1qmdnKS

Mountain View #mural #streetart #publicart #art #building #windows

Mountain View #mural #streetart #publicart #art #building #windows

from Instagram http://bit.ly/1m8y5tg

The Vitamin Vault - Walgreens in Historic Bank

This is a Walgreens store located inside a historic bank building in Chicago. It has been a very talked about redevelopment project including Huffington Post and Forbes.

I came across this photo on Instagram:

from Instagram http://bit.ly/1qGCAPW

via jorgemus

The Vitamin Vault #chicago #architecture #bank #walgreens #farmacy #vitamins #vault #door #metal #health #shopping #design

Here is an exterior shot before the signs went up:

Now just waiting for the unicorn to show up

My backyard....

Now just waiting for the unicorn to show up

from Instagram http://bit.ly/1oGEo9Z

Always Doing Both

“The master in the art of living makes little distinction between his work and his play, his labor and his leisure, his mind and his body, his information and his recreation, his love and his religion. He hardly knows which is which. He simply pursues his vision of excellence at whatever he does, leaving others to decide whether he is working or playing. To him he's always doing both. ” ~James A. Michener~

as seen on Instagram via solo_with_gopro

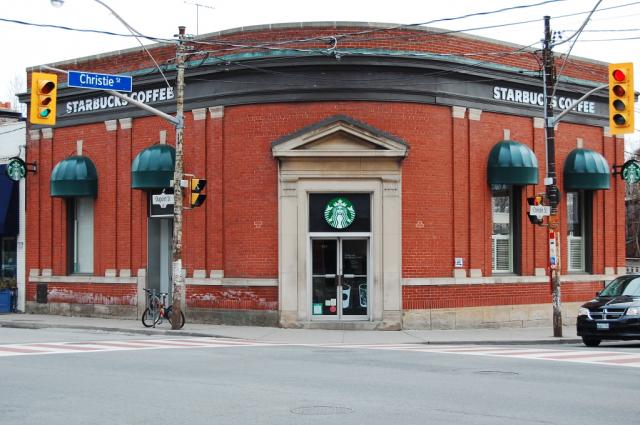

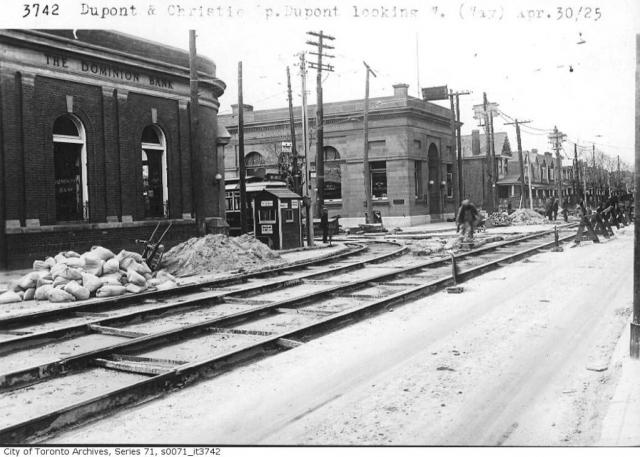

Historic Bank Building turned "Green" Starbucks

Here is a beautiful historic bank building that has been converted into a Starbucks in Toronto, Canada.

Although I could not find too much information on the history of the building I did find some information about the location being a "green" renovation.

USGBC has awarded the project a LEED ID+C: Retail v1.0 pilot rating. This project achieved certification at Certified level in May 2013 and achieved 21 points.

#color #palette #vintage #wood #white

I am a sucker for old wood, faded color and texture. Add an old tin can patch and I'm sold. Taken in an alley downtown Carbondale, CO.

#color #palette #vintage #wood #white

from Instagram http://bit.ly/1mb8KMS

We all need a big carrot to chase.

We all need carrots to chase.

#publicart #outdoorart #carbondale #co

from Instagram http://bit.ly/1oNmx0R

Adaptive Reuse - School, Church & Starbucks

Great example of adaptive reuse project with corporate tenants:

Old School O7 in Phoenix, AZ

Vital Stats

Opened: 2013

Vital Stats

Opened: 2013

Owned: Wetta Ventures

Size: +/- 9,000 SF

Team: PK Associates, RSP, Chasse Building Team, MSA Engineers, TwinEngine Design, Airpark Signs & Graphics

Old School O7 ("O" for Osborn Road; "7" for 7th Street) is an adaptive reuse and new construction project in Midtown Phoenix. The project consists of a 1,700-square foot freestanding drive thru building that is leased to Starbucks. The existing 4,075-square foot church, built in 1948, will be re-purposed as a new restaurant for Z'Tejas new concept, Taco Guild. The remaining, 3,518 square feet housed in the 1955 school building will serve as new shop space for general retail uses. The project represents a one of kind redevelopment project with a 100+ year history - a combination of new construction and adaptive reuse that will spur further economic growth in the neighborhood.

What people are saying: ‘This is a great example of responsible development, as it retains a piece of Phoenix history while meeting modern needs’ -Tom Simplot, Phoenix City Councilman

source via Old School O7 –.

Slow time of year in #aspen , time for a #nap

Slow time of year in #aspen time for a #nap

from Instagram http://bit.ly/1jLfTAq

Perfect start to my birthday morning

Perfect start to my birthday morning #coffee and @dwellmagazine

from Instagram http://bit.ly/1kgzbSQ

Good Deals find Good Money

Freshman year in college, I met a friend. The friend's dad was a commercial real estate developer. I had always wanted to learn more about commercial real estate given that my dad was in the hardware business, owned his stores and as well as a few strip centers. I offered to take my friend's dad to lunch. He actually took me to lunch. We visited his office. Met his small staff: an office manager (the type of woman who you know is the one who really runs things and makes sure it all stays together) and "the engineer" who also wore hats as an architect, surveyor and a lawyer. Three people, the manager, the engineer and the developer.

The conversation zig-zagged from "how's school?", to naive questions from an eighteen year old, to real nuts and bolts lessons from the trenches of a life long commercial real estate person.

Boom times in Deer Valley, UT. Major failures in Vail. Huge successes in Chicago and the midwest. Now, if only the city would agree to that damn traffic light and bypass at project so and so.

"See now" the mentor said. "Your dad has to open the stores everyday. Someone has to unlock the doors and let the customers in. I did not want to open the doors everyday, I wanted to own the doors and collect the rent."

He continued with more stories of leases and financing and lore. His excitement was relentlessly contagious.

"The yield, I do it for the yield." (Yield what's that?) He grabbed his HP off the desk. "Look, cap rate. Capitalization rate." He punched the numbers in the calculator. Rent, net income, price, value, yield, cap rate.

The specifics pretty much went over my head. However, the lesson sunk in. Income streams create value. Income streams are created by location, tenants and buildings. By the enterprising developer, of course. (And, if I really understood it correctly, I would never have to work in a hardware store the rest of my life.)

His projects were big. Even by today's measure. He was on the leading edge of developing these new projects that are now commonly referred to as Power Centers or Regional Centers. Not malls. Kohls. Bed Bath & Beyond. Dick's. Best Buy. Target. All in one project perfectly located to draw shoppers from all directions from up to 30 minutes away. And not to mention the in-line retail spaces that were really just gravy.

These projects were 10, 20, 50 million dollar deals. I could not even fathom the dollars. When he showed me the numbers the last 000 were not written. Everything was short form for million. 1,000 was $1M. 20,000 was $20M. Wow, I thought.

"But, but, but.. where, I mean how do you come up with money?" I said. He replied "That's the easy part. The money finds me. I create the deal and the money comes."

Uh. OK. Sure. My 100 was $100, not $100,000.

---------

Many years later, after being in the CRE a while myself. I decided it was time to do my own deals.

How would I finance them? Where would the money come from?

I remembered that first CRE lesson as an 18 year old hippie (yes, I had a ponytail at the time).

Just to be sure, I asked a CCIM friend what the best deals would be to get started in and get financed. He said it does not matter. What, all these people are crazy, I thought. Millions of dollars easy to get? I asked him to extrapolate.

"Good deals find Good Money" he said. "There is so much money out there. Sitting there. Just looking. Waiting. Looking for a home. A good deal."

A good deal, he explained, was one that was fundamentally strong. Good location. Good building or bones. No hair. (environmental or title issues etc.) Good tenant(s). Good price. Nothing over the top. Just good all around. Solid.

Even better if it had upside: below market rents, extra land, below market purchase price, etc..

In other words, create a good deal and the money will come.

I have now seen it first hand. Whether it be my own land subdivision on the river that was easy to sell the parcels at crazy prices. Or a $12M Walgreens with non-recourse financing. Or a NNN Dollar General attracting multiple all cash buyers. Or a trailer park on the river with unsolicited offers.

Bad deals or marginal deals on the other hand struggle. Languish. Sit on the market. Need personal guarantees (and your first born child). Fall apart.

Finally, I got it. And get it.

Thank you Mr. Cap Rate.

-------------

Now, what is this all about? It is about a new kind of deal. A deal that is not just about money. It is a deal that does good. Of course it makes money. But it does not have to take every penny off the table. It is a deal that does good at the same time while making money. A deal that helps people. Helps the environment. Maybe helps animals. A deal that does good.

The current lingo is "impact investment" or "social fund" or "CSR (Corporate Social Responsibility).

I see these deals as building reuse, parks from vacant lots, public art, community uses, historic preservation, corporate reuse, conservation or any real estate deal that can actually do some good besides just make money.

Do you care? If you do, call or email me to find out more. I'm not eighteen anymore.

-------------

Making money is art and working is art and good business is the best art.

- Andy Warhol

Transdisciplinarity

A discipline to call our own. Andrus & Morgan is a creative real estate company that does important work on meaningful projects nationwide.

We specialize in commercial real estate reuse, repositioning and investment.

We make the world a better place by combining real estate redevelopment, impact investing, media, design, architecture, historic preservation, crowdfunding, green, reuse, finance, commercial real estate, residential real estate, non profit, real estate donations, web, technology, crowdsourcing, social media, law, planning, land use, brokerage, conservation, philanthropy, marketing, art, public affairs and CSR.

For a minute, we seriously considered blending all the disciplines above into one word. In the end, we felt that this company name was too long (laugh laugh):

The Real Estate Impact Media Design Historic Crowdfunding Commercial Non Profit Weblaw Planning Use Philanthropic Art Affair Firm

We settled on Andrus & Morgan instead.

Besides the unseen well of daily inspiration that has created all of this, Candy Chang helped me take the leap with this short two minute video about "Making your own Discipline". Thanks Candy!

Public Art: LOVE

Featured public art of the day.

Robert Indiana LOVE sculpture in Tokyo

from Instagram http://bit.ly/1lJLo2r

via danap07

LOVE #robertindiana #publicart #tokyo #shinjuku

List of LOVE sculptures can be found here.

LOVE is an iconic Pop Art image by American artist Robert Indiana. It consists of the letters LO over the letters VE; the O is canted sideways so that its oblong negative space creates a line leading to the V. The original image, with green and blue spaces backing red lettering, served as a print image for a Museum of Modern Art Christmas card in 1964. In much this same form the design soon graced a popular US postage stamp. Its original rendering in sculpture was made in 1970 and is displayed in Indiana at the Indianapolis Museum of Art. The material is COR-TEN steel Indiana's LOVE design has since been reproduced in a variety of formats for rendering in displays around the world.

MoMA historian Deborah Wye describes Indiana's image as "full of erotic, religious, autobiographical, and political underpinnings" that make it "both accessible and complex in meaning". Megan Wilde offered more detail about the autobiographical origins in an article for Mental Floss magazine, "The word love was connected to [the artist's] childhood experiences attending a Christian Science church, where the only decoration was the wall inscription God is Love. The colors were an homage to his father, who worked at a Phillips 66 gas station during the Depression." She quotes Robert Indiana as describing the original colors as "the red and green of that sign against the blue Hoosier sky." via Wikipedia

How To Find The Best NNN Properties For Sale

Finding a good selection of NNN properties for sale is not as easy as you might hope. Because there is no reliable central repository of commercial listings, the NNN properties for sale in the market are typically spread across a number of different resources, only some of which are freely available to the public.

Finding a good selection of NNN properties for sale is not as easy as you might hope. Because there is no reliable central repository of commercial listings, the NNN properties for sale in the market are typically spread across a number of different resources, only some of which are freely available to the public.

Internet Listings of NNN Properties for Sale

There are a few sites which present NNN properties for sale as well as other commercial real estate listings. The two best known, Loopnet and Costar Exchange, are in the process of merging. Both allow just about anyone to post listings of NNN properties for sale, as well as other property types. While Costar lets anyone search its database, Loopnet only gives full access to paying subscribers. The key problem with these sites is that many of the best NNN properties for sale never make it on to them.

Principal Listings of NNN Properties for Sale

Many principals, whether they are owners or developers, list their own NNN properties for sale on their websites. CrestNetLease and Kimco Realty are two such ownership groups that do this, and Bencor Development is an example of a developer that posts its NNN properties for sale right online. Although direct principal to principal marketing can yield you access to inventory, it is a great real of work to visit each of these sites. In addition, because you do not have an expert guiding you, you may not know which of the NNN properties for sale that you see are good deals and which are not.

Hire A Professional Broker to Bring You NNN Properties for Sale

The easiest way to find NNN properties for sale is also the best way. Instead of spending your time to scour the Internet to find just a small subset of the NNN properties for sale out there, hire a broker and let him do the work for you. Your broker should have not only a strong knowledge of all of the places to look for NNN properties for sale, but should also have insider access to listings that you may not be able to see. In addition, he should be able to guide you to not only good NNN properties for sale, but to the best NNN properties for sale for you and your specific needs. In addition, because most sellers will pay your broker’s commission, the service and guidance that he brings you should not even cost you anything.

{ Article: How to Choose the Best Triple Net Broker }

Or call Thomas Morgan, CCIM, a Triple Net NNN Broker, at 1-866-539-1777

Former Bank Building #adaptivereuse as AT&T retail #cre

from Instagram http://bit.ly/1qGCAPS

via realtmo

Former Bank Building #adaptivereuse as AT&T retail #cre